Make the U-Turn:

From Debt Pressure to Customer-Centric Collections

Collections don’t have to feel like a dead end.

At Recuvery, we believe it’s time for a U-turn in the way businesses recover payments—shifting from outdated, high-pressure methods to empathetic, customer-first experiences.

When collections are customer-centric, everyone wins:

Customers get the flexibility and respect they expect.

Businesses recover more revenue while protecting relationships.

Teams gain efficiency with automation that works behind the scenes.

This is the new standard of collections. A clear path forward where trust, compliance, and recovery move hand in hand.

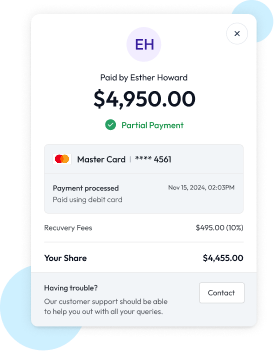

Smarter Partial Payments. Happier Customers. Stronger Cash Flow.

Sometimes customers can’t pay the full amount in one go. Other times, they want to pay ahead.

With Recuvery’s new Partial Payment Logic, every payment—big, small, or in-between—is automatically applied in the smartest way possible:

Installments covered first.

Payments are allocated to fully cover upcoming dues, one by one.

No money left behind.

Extra amounts roll into the next installment, keeping the plan on track.

Due dates that make sense.

If a customer pays ahead, their next due date adjusts automatically.

What This Means for Your Business

Improved Cash Flow

Simpler Management

Better Customer Experience

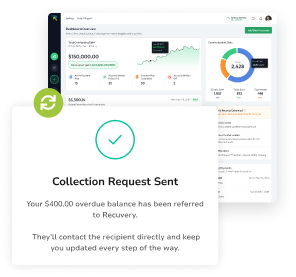

Expanding the Reach of Collections by Centralizing Overdue Accounts

What does it take to scale collections across industries—without disrupting the way you already work? For us at Recuvery, the answer is simple: a strong integration system that makes connecting effortless.

Our new initiative with Lendee, a peer-to-peer microfunding app, brings that idea to life:

Seamless Experience:

Lendee users can push overdue accounts straight into Recuvery—no changes required.

Built to Scale:

Whether you’re managing 10 accounts or 1,000, Recuvery keeps collections consistent and effective.

Bigger Picture:

This integration shows how Recuvery turns overdue accounts into growth opportunities—keeping collections effective, compliant, and customer-first.

Faster Collections, Smarter Accounting

Recuvery + QuickBooks

Collections and accounting usually live in two different worlds. And it leaves your team to fill the gap with endless spreadsheets and double-checks. With Recuvery’s new QuickBooks integration, those days are over.

Here’s how it changes the game for your business:

Get Paid, Stay Accurate.

Every payment—full, partial, or plan—syncs instantly, so your books always stay updated.

No More Manual Fixes.

Customer records update automatically, cutting down on errors and saving hours each week.

Decide Faster.

Real-time numbers give you the confidence to act quickly, whether it’s planning cash flow or investing in growth.

Blog Spotlight:

A Guide to Commercial Debt Collection

For many businesses, unpaid invoices can stall growth and strain valuable client relationships.

Our latest blog explores how to navigate B2B debt recovery with clarity and confidence.

Here’s what you’ll learn inside:

What commercial debt collection really is—and why it’s critical for every B2B company.

Typical scenarios businesses face when chasing overdue payments.

Best practices to prevent overdue accounts and protect cash flow.

From Our July Edition:

Key Updates You May Have Missed

In July, we spotlighted a series of enhancements designed to make collections smarter and more connected:

Custom Mobile App →

Customers gained the ability to pay anytime, track their accounts, and stay updated without back-and-forth calls.

Automated & Branded Messaging →

Every letter, SMS, and email stayed consistent, compliant, and on brand—without manual drafting.

Real-Time Analytics & Dashboards →

Businesses got clearer visibility into overdue accounts and the real impact of automation.

White Paper Spotlight →

A deep dive into how self-serve repayment tools are reshaping customer behavior and speeding up recovery.

We’ll be back with more updates to keep your collections simple, smart, and customer-first.

Until then—recover smarter with Recuvery.

Copyright © Recuvery. All rights reserved.