From Unpaid Invoices to Stronger Business Relationships

For most businesses, the challenge isn’t getting clients to pay. It’s finding a consistent, respectful way to follow up without damaging rapport or spending hours on manual outreach.

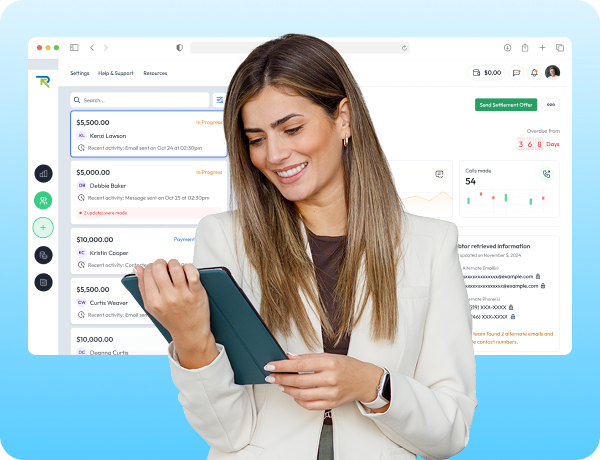

Recuvery helps you turn those moments into opportunities to strengthen trust and improve efficiency. With automated reminders that sound like they came from your team, real-time visibility across every account, and flexible payment options for your clients, you can maintain professionalism while ensuring your cash flow stays healthy.

A Smarter Way to Manage Client Payments

Commercial debt collections shouldn’t feel like conflict. Recuvery brings structure and transparency to how businesses handle overdue accounts — combining advanced automation with brand-aligned communication.

Branded Reminders

Every message is polite, consistent, and designed to protect your company’s reputation.

Simplified Invoicing & Tracking

View all client balances in one clean dashboard, organized for faster decisions.

Client-Friendly Payment Options

Allow clients to resolve dues through flexible repayment plans that fit their business needs.

Insights That Fuel Action

AI-powered prioritization identifies which accounts are ready to resolve — saving time and improving recovery rates.

Positive Payment Reporting

Build credibility by rewarding clients who pay on time, strengthening long-term trust and cooperation.

Why Businesses Choose Recuvery

Efficiency Without Pressure – Automate the routine so your team can focus on growth and service.

Transparency That Builds Confidence – Keep every transaction visible and accountable.

Ethical Collections, Stronger Partnerships – Protect your brand and maintain goodwill in every interaction.

Adaptable for Any Scale – Whether managing a handful of invoices or hundreds of accounts, Recuvery grows with your business.

Commercial Debt Collections

That Protect Both Cash Flow & Connection

Late payments don’t have to mean lost relationships. Recuvery helps you bring order, professionalism, and understanding to the process — ensuring your business stays focused on progress, not past-due payments. Collect faster. Maintain trust. Keep business moving forward.