Credit Memo

What Is a Credit Memo?

A credit memo, short for credit memorandum, is a document issued by a seller to a buyer to reduce the amount owed by the latter. It is typically issued when there has been an overcharge, goods are returned, or any other adjustment needs to be reflected in the customer’s account.

In simple terms, a credit memo works like a negative invoice. It decreases the customer’s outstanding balance instead of increasing it. It’s an important financial document that helps businesses maintain accurate records, manage billing errors, and uphold healthy customer relationships.

Let’s understand this with an example:

Suppose you sell 10 products for $1,000, and the customer later discovers that 2 items are defective and returns them. You would issue a credit memo for $200 to reduce the customer’s balance accordingly.

This adjustment can be provided in the form of store credit, cash refund, or an offset against future purchases, depending on your business policy.

Why Are Credit Memos Important for Businesses?

Financial operations are complicated. To keep them streamlined, it is essential to eliminate factors that can cause errors to creep in. Credit memos help businesses do exactly that. They not only correct the invoice but also help enterprises maintain their relationships, ensure compliance, and keep accounting records precise.

Here’s why credit memos are important:

➮ Maintain Accurate Financial Records

Credit memos ensure that your books reflect the true value of transactions and avoid confusion. They help correct overbilling, returns, and other discrepancies so that both revenue and accounts receivable remain accurate.

Without them, a business may unintentionally overstate its income or customer balances, leading to errors in financial reporting and tax calculations.

➮ Strengthen Customer Relationships

Transparency and trust are of the utmost importance when dealing with customers. When a business issues a credit memo promptly to rectify an error, it reflects professionalism and fairness. It reassures customers and fosters trust and loyalty in the long run.

➮ Simplify Account Reconciliation

Maintaining accurate and error-free financial statements is essential for any business. That’s where credit memos come in handy, especially during month-end or year-end reconciliations. By formally documenting every correction, businesses can easily trace, verify, and validate any changes made to customer accounts.

➮ Support Audit and Compliance Requirements

Properly issued credit memos create a clear paper trail for all financial adjustments. This documentation is essential for internal audits, external reviews, and compliance with accounting standards and tax regulations.

➮ Improve Cash Flow Management

Outstanding balances can create confusion, especially when there are changes in the amount owed. A credit memo helps keep customer balances accurate, allowing businesses to track payments more effectively and minimize disputes or collection delays. By maintaining a clear and well-managed credit memo process, businesses can ensure smoother billing cycles and steady cash flow.

➮ Enhance Internal Accountability

Issuing credit memos through a formal process ensures that all adjustments are authorized, recorded, and traceable. This helps prevent misuse, fraud, or informal write-offs, promoting accountability within the finance and sales teams.

When and Why Are Credit Memos Issued?

As discussed above, a credit memo is issued by a seller whenever there is a need to adjust a customer’s balance due to changes in the original transaction. Now the question arises, what are the scenarios in which a business may issue a credit memo? Here’s a list with examples:

➧ Returned or Damaged Goods

Every business strives to deliver products in perfect condition, but sometimes things don’t go as planned. There’s always an element of uncertainty; items may arrive damaged, contain defects, or differ from what the customer ordered.

In such cases, a credit memo is issued to adjust the value of the returned or rejected goods.

Example: A customer purchases 50 T-shirts worth $500 but returns 10 defective pieces. The seller issues a credit memo for $100 to reduce the customer’s payable amount.

➧ Overbilling or Pricing Errors

Discrepancies such as miscalculations, incorrect price entry, and duplicate billing can crop up in manual processes. It can lead to a customer being charged for more than agreed upon.

A credit memo is then required to correct the overcharge.

Example: A consulting firm invoices a client for 20 hours of work instead of 15. Once the error is identified, the firm issues a credit memo for 5 extra hours to adjust the total bill.

➧ Post-Sale Discounts or Goodwill Adjustments

Sometimes, businesses offer discounts after the sale as a gesture of goodwill, a loyalty reward, or a customer retention strategy. A credit memo formally documents this reduction.

Example: To thank a repeat customer, a vendor decides to give an additional 5% discount on an already-issued invoice of $2,000. A credit memo for $100 is issued to account for this adjustment.

➧ Service Cancellations

Not all deals go as planned. When a client cancels a service before it is fully rendered, the seller may issue a credit memo to adjust the charge for the unutilized portion.

Example: A marketing agency bills a client for a three-month campaign, but the client cancels after one month. The agency issues a credit memo for the remaining two months’ fees.

➧ Delivery Shortages or Missing Items

If the goods delivered fall short of the quantity billed, a credit memo helps reconcile the difference between the invoice and the actual delivery.

Example: A supplier invoices for 100 units but delivers only 95. The supplier issues a credit memo for the 5 undelivered units to balance the account.

➧ Contract Adjustments or Policy Revisions

Businesses may need to issue a credit memo when contractual terms change or pricing policies are updated after an invoice is sent.

Example: A software company revises its subscription plan pricing mid-contract and lowers rates for existing clients. A credit memo is issued to reflect the reduced charges.

What Does a Credit Memo Include?

A professional credit memo should contain clear and complete information to avoid confusion. Here’s what to include:

- Credit Memo Number: A unique identifier for tracking and reference.

- Date of Issue: The date the credit memo is created.

- Customer Information: Name, address, and contact details of the buyer.

- Seller Information: Your business details.

- Original Invoice Number: Reference to the invoice being adjusted.

- Description: Reason for issuing the credit memo (e.g., “Returned defective items”).

- Amount: The credit amount to be applied.

- Tax Details: If applicable, note any tax adjustments.

- Authorized Signature: Sign-off from the issuing party for validation.

How to Issue a Credit Memo?

Issuing a credit memo is a straightforward process that can be handled manually or through accounting software, depending on your business setup. Before you begin, decide how the adjustment will be provided — store credit, a cash refund, or an offset against future purchases — based on your company’s policy and the customer’s preference. Here’s a step-by-step guide:

1. Identify the Need: Determine why the credit memo is required—return, discount, billing error, etc.

2. Locate the Original Invoice: Match the issue with the correct invoice to ensure accurate adjustments.

3. Create the Credit Memo: Include all relevant details—reason, reference number, amount, and customer details.

4. Send It to the Customer: Share the document via email or your accounting platform. Ensure your customer acknowledges receipt.

5. Record the Transaction: Update your accounting books or software to reflect the credit. This ensures your accounts receivable balance adjusts correctly.

6. Apply the Credit: When the customer makes their next payment or has a new invoice, apply the credit amount to reduce their payable total.

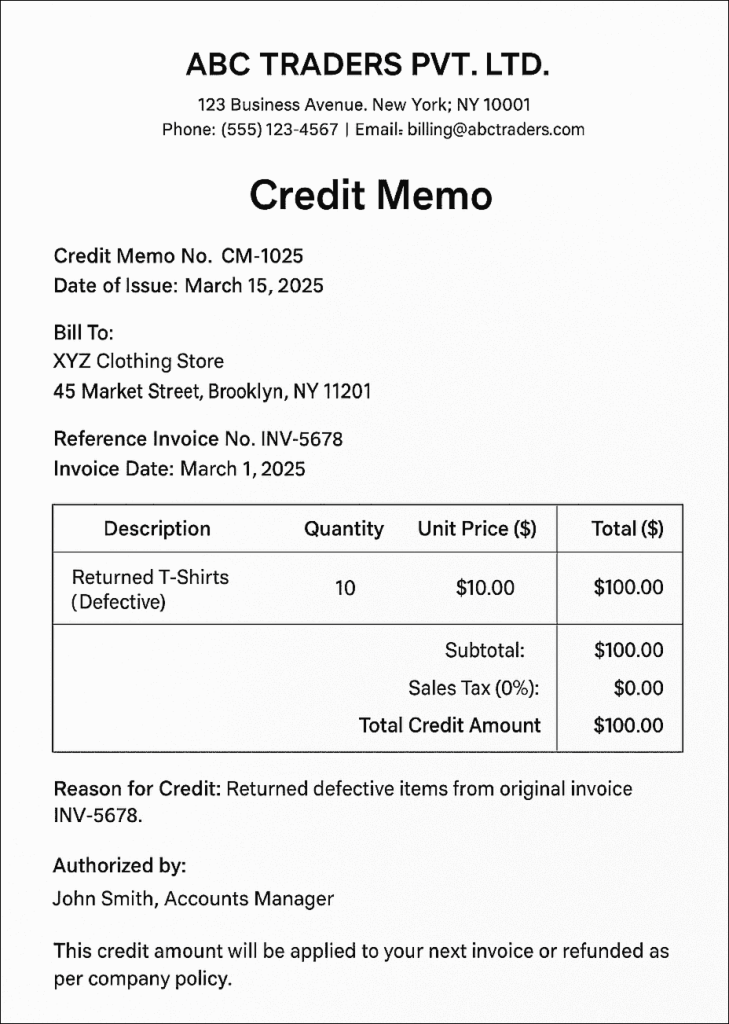

And how do you draft one? Below is a credit memorandum example for your reference.

Credit Memo Sample

A credit memo must contain all the essential details that clearly explain what amount is being adjusted and which invoice it relates to. To help you get started, we’ve created a simple credit memo template for your reference. Feel free to customize this credit memo example based on your business requirements.

Although this credit memo example is easy to understand on its own, businesses often confuse a credit memo with a refund or a debit memo. We have broken down key differences for your reference in the following sections.

Credit Memo vs. Refund

While both a credit memo and a refund address customer dissatisfaction or billing errors, they serve different purposes. A credit memo reduces the amount a customer owes and is usually applied to future purchases, keeping the value within the customer’s account. On the other hand, a refund involves returning money directly to the customer, closing the transaction, and creating a cash outflow for the business.

| Credit Memo | Refund |

| Adjusts or reduces the amount owed by the customer | Returns money directly to the customer |

| Typically applied to future invoices or purchases | Ends the transaction completely |

| Keeps funds within the customer’s account balance | Involves an immediate cash outflow |

| Useful for maintaining ongoing customer relationships | Often used for canceled or returned orders |

Debit Memo vs. Credit Memo

After understanding how credit memos differ from refunds, one more aspect that needs to be discussed is debit memos. A debit memo serves the opposite purpose of a credit memo. While a credit memo reduces the amount a customer owes, a debit memo increases it — usually when there’s an underbilling, additional service charge, or pricing adjustment after the original invoice.

In simple terms, a credit memo gives money back (or reduces a balance), whereas a debit memo requests additional payment.

| Credit Memo | Debit Memo |

| Decreases the customer’s outstanding balance | Increases the customer’s outstanding balance |

| Issued for overbilling, returned goods, or discounts | Issued for underbilling, extra services, or late fees |

| Reflects a reduction in the seller’s accounts receivable | Reflects an increase in the seller’s accounts receivable |

| Example: A seller issues a credit memo for $200 for returned goods | Example: A seller issues a debit memo for $50 for additional shipping costs |

Best Practices for Managing Credit Memos

Credit memos are used to simplify the processes and ensure transparent and accurate records. But to do so effectively, you must follow certain best practices. Here’s a list for your reference:

1. Always issue a formal document

Avoid relying on verbal or informal agreements. A formal, written credit memo provides a clear record of the transaction and serves as proof for both the seller and the buyer.

2. Reference the original invoice

Every credit memo should clearly mention the corresponding invoice number. This helps link the adjustment directly to a specific transaction, making it easier to track and validate later.

3. Maintain a consistent numbering system

Assign a unique, sequential number to each credit memo. A consistent numbering format helps maintain organized records and simplifies audits or reconciliations.

4. Use accounting software for accuracy

Modern accounting tools automate the process of creating and recording credit memos, minimizing human errors. They also ensure that credits are properly applied to customer accounts in real time.

5. Reconcile credits regularly

At the end of each month or financial period, review and reconcile all issued credit memos to ensure that balances match and no adjustments have been missed. Regular reconciliation prevents discrepancies from escalating over time.

6. Communicate clearly with customers

Always inform the customer when a credit memo has been issued and explain the reason behind it. Transparent communication fosters trust and reduces potential misunderstandings.

Final Thoughts

Credit memos may seem like small accounting documents, but they play a big role in maintaining trust, accuracy, and financial integrity. For business owners, understanding how to issue and manage credit memos correctly can save time, reduce disputes, and improve customer relationships.

By keeping a clear credit memo process in place — supported by reliable accounting tools — you ensure that every transaction in your business remains fair, documented, and transparent.

In the long run, those small adjustments add up to stronger financial control and smoother operations.

FAQs

1. What Is a Credit Memo in Accounting?

A credit memo in accounting is a document issued by a seller to reduce the amount a buyer owes, often due to returns, overbilling, or discounts.

2. What’s a Memo on a Check?

A memo on a check is a short note written by the payer to describe the purpose of the payment, such as “July rent” or “Invoice #102.”

3. What Is a Credit Memo in QuickBooks?

In QuickBooks, a credit memo records a reduction in a customer’s balance and can be applied to future invoices or refunded directly.

4. What Is a Credit Memo Journal Entry?

A credit memo journal entry records the reduction in a customer’s balance. It usually means decreasing revenue and reducing the amount the customer owes in your accounts.

5. What Are Credit Memos From the Bank?

A bank credit memo is an entry made by the bank to increase a company’s account balance, often for interest income, refunds, or error corrections.

6. What is a credit invoice?

A credit invoice is another term for a credit memo. It’s a document issued by a seller to reduce the amount a customer owes due to returns, overcharges, or adjustments to the original invoice.