Why This Integration Changes the Game

Smarter Prevention

FinanceMutual’s AI creates personalized plans that help customers stay on track — reducing defaults before they start.

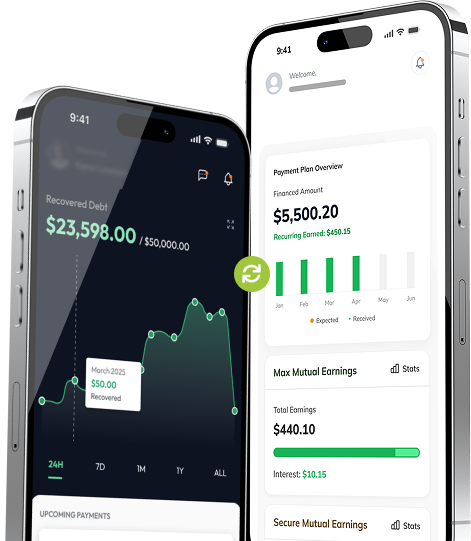

Faster Recovery

If accounts do fall overdue, Recuvery steps in with branded reminders, and mobile-first payment options without harming relationships.

Revenue Flow Without Gaps

From the moment a plan is created to the final recovered payment, every step is synced — ensuring your revenue pipeline runs smoothly.

Efficiency That Extends to Customers

This isn’t just about businesses — customers win, too:

Confidence

AI-tailored plans make repayment achievable, while Recuvery’s options keep customers in control even if they fall behind.

Trust

Every payment, whether on time or late, is tracked and visible across both systems — customers know where they stand.

Loyalty

On-time and recovered payments alike can be reported positively, turning repayment into a path to rebuild credit.

Less Risk, More Growth

With Recuvery and FinanceMutual connected, your business gets predictive power and recovery strength in one ecosystem. It’s simpler for you, smoother for customers, and smarter for long-term growth.