A Year of Progress & Partnership

AI-Led Collections for a Smarter, Stronger New Year

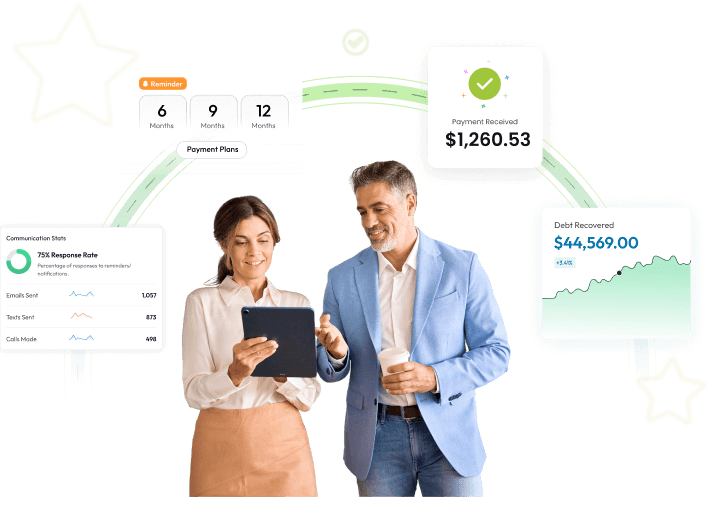

Collections are entering a new phase! One driven by intelligence, accuracy, and real-time visibility.

At Recuvery, we’re now stepping into the new year with capabilities that help businesses prioritize better, act faster, and stay fully compliant. With AI-guided prioritization, centralized communication logs, and built-in compliance guardrails, your team can recover more revenue.

This isn’t just an upgrade — it’s the foundation for the next generation of collections, built on a year of learning, collaboration, and shared success.

How Recuvery Evolved in 2025

A Snapshot of the Enhancements That Strengthened the Platform

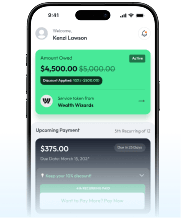

Custom Mobile App for Customers

Secure anytime payments, instant reminders, and full account visibility — giving customers flexibility during busy seasons and beyond.

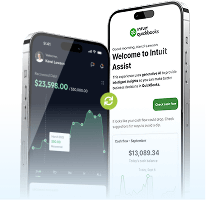

QuickBooks Integration for Smarter Accounting

Automatic, year-end-ready payment syncs that keep your books accurate and reduce hours of manual reconciliation.

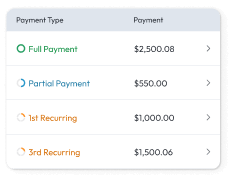

Intelligent Partial Payment Logic

Smarter payment allocation that keeps plans on track — especially helpful when customers adjust their payments around holidays or financial cycles.

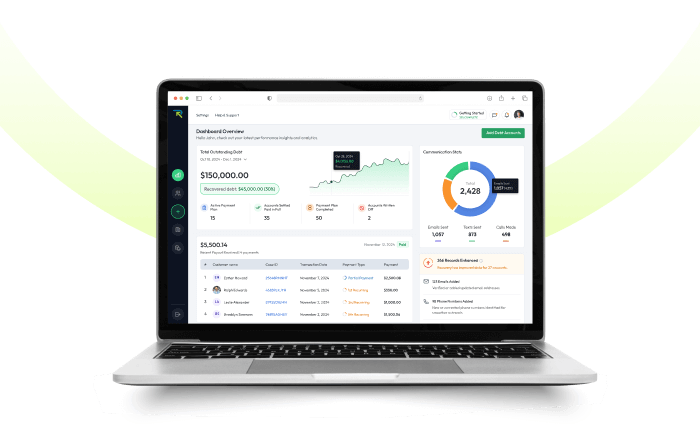

Real-Time Analytics & Centralized Dashboards

Instant insights into slow accounts, automation savings, and recovery performance — helping teams end the year with clarity and start the next with confidence.

These enhancements strengthened Recuvery’s foundation, giving businesses smarter workflows, better visibility, and a more resilient collections process.

Centralized Communication Log

Every Interaction, All in One Place

Recuvery solves scattered communication challenges with a unified Communication Logs module that brings everything together in one real-time view.

The module consolidates all customer interaction records — Emails, SMS, Calls, and Demand Letters — into a single interface. By centralizing these touchpoints, your team gains clearer visibility into every action performed and stronger control over the entire communication journey.

Here’s how it elevates your workflow:

One Timeline, Zero Guesswork.

Every interaction is captured and organized in one searchable thread.

Better Team Coordination.

Know who contacted the customer, what was sent, and what needs to happen next — without duplication.

Clearer Customer Experience.

Consistent, professional messaging backed by complete history.

Stronger Compliance.

Time-stamped, documented communication that minimizes risk and simplifies audits.

Blog Spotlight

Smart B2B Debt Collection Strategies Businesses Should Use

For many B2B companies, overdue invoices don’t just delay payments — they impact operations, client relationships, and growth.

Our latest blog outlines practical steps to strengthen your commercial collection process with clarity and structure.

Inside, you'll learn:

-

What B2B collections really involve and how they differ from B2C

-

The biggest mistakes affecting repayment speed — and how to avoid them

-

How Recuvery’s B2B tools streamline work and improve recovery

A must-read for any business managing commercial accounts or recurring invoices.

From Our October Edition

In Case You Missed It

October brought several important updates that strengthened the Recuvery platform. Here are the key highlights:

QuickBooks Sync

Automatic syncing for full, partial, and installment payments to keep your books accurate without manual work.

Partial Payment Logic

Smarter payment allocation with auto-adjusting due dates that keep repayment plans on track.

Lendee Integration

A direct pipeline for pushing overdue accounts into Recuvery for consistent, scalable recovery.

Customer-First Collection Approach

Enhancements that focus on flexible payment paths and respectful communication with customers.

Recuvery continues to evolve with one goal in mind: helping businesses recover revenue faster, operate with clarity, and deliver a better experience to every customer.

We’ll be back with more updates, insights, and tools to support your collections in the months ahead.

Until then—keep recovering smarter with Recuvery.

Copyright © Recuvery. All rights reserved.