Collection Agency for Unpaid Rent: A Guide for Landlords

Quick Answer

What is Rent Collection Agency?

A rent collection agency acts as an intermediary that specializes in recovering the outstanding rent owed by a tenant to a landlord. They employ various methods such as demand letters, negotiations, negative credit reporting, and legal action for recovery. They get a commission based on the contingency of recovering the past-due rent successfully. However, before taking drastic measures, a simple approach of using an automated debt recovery system can help landlords avoid the collection hassle.

Tenants not paying their rent can be the most concerning part of being a landlord. When a tenant leaves behind outstanding rent, it can feel pretty stressful to deal with. So, most landlords hire a rent collection agency to deal with it on their behalf. After all, collecting unpaid rent can be pretty challenging.

Accumulating outstanding rent payments can make it difficult for landlords to keep up with property expenses and also impact their cash flow. So, it’s crucial to stay on top of the collections as a property owner. You should know your rights and the available options for rent debt collection.

In this blog, we’ll discuss all about what steps you should take, whether you should hire a rent collection agency, and what other rent collection options you should explore before hiring a collection agency for unpaid rent.

When Does Unpaid Rent Go to Collections?

A landlord can send the unpaid rent to collections after other attempts to collect the debt have failed and the landlord has also given reasonable time to the tenant to clear the outstanding rent. The grace period is typically 3-5 days after the rent due date. However, if the rent remains unpaid for 30 to 90 days past the due date, it can be sent to a rent debt collection agency. Though some landlords may take action within 30 to 60 days of non-payment.

A landlord can also send the tenant to a rent recovery collection agency in the following scenarios:

♦ Eviction: If the tenant has been evicted due to the overdue rent and still hasn’t made a move to clear the debt.

♦ Breaking the lease without paying rent: If a tenant abandons the property without notice and breaks the lease without paying the due rent, the landlord can hire a debt collection agency to recover it.

♦ Move out without paying outstanding rent: If the lease agreement ended and the tenants moved out, but they still owe outstanding rent to the landlord.

♦ Property damage: If the tenant caused property damage before the lease expired and left without paying despite attempts by the landlord, they can go to professional collection agencies for recovery.

So, if all else fails and the tenant does not respond, the landlord may consider going to the best collection agency for unpaid rent recovery rather than dealing with it themselves.

Choosing the Best Collection Agency for Unpaid Rent

Factors To Consider Before Hiring a Rent Debt Collection Agency

🔸 Verify the agency’s licensing and accreditation.

🔸 Get recommendations from local landlord associations.

🔸 Consider how much experience they have with rent recovery.

🔸 Consider the reputation of the agency.

🔸 Ensure the debt collection agency you choose complies with the Fair Debt Collection Practices Act (FDCPA).

🔸 Compare the commissions and other fees associated with rent recovery services before making a final decision.

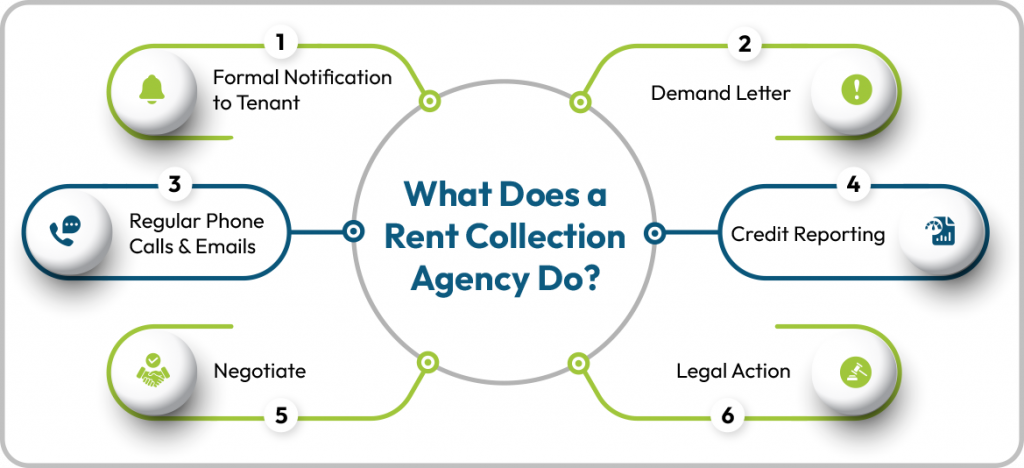

What Does a Rent Collection Agency Do?

A rent recovery collection agency steps in when a tenant falls behind on payments and their account is sent to collections. They employ a range of tactics for recovery:

i. Formal Notification to Tenant

They start by notifying the tenant regarding the unpaid rent amount, late fees, and any amount owed for breaking the lease or property damage, etc.

ii. Demand Letter

The collection agency may send a demand letter, which is a legal communication document that works as a formal written notice demanding tenant pay the outstanding rent. It usually contains a specified timeframe to clear the unpaid rent. Failure to comply may result in legal action, such as eviction or other penalties.

iii. Regular Phone Calls & Emails

The past due rent collection agency also takes over the hassle of contacting the tenants to persuade them to fulfill their overdue rent obligation. They are required to follow the Fair Debt Collection Practices Act (FDCPA) regulations. They may make phone calls from different numbers, send emails, or letters to establish a communication channel with the tenant.

iv. Credit Reporting

After the reasonable timeframe to settle the debt has passed, they may report the unpaid debt account in collections to the credit bureaus. This can negatively affect the tenant’s credit rating. A low credit score may also make it difficult for tenants to rent in the future.

v. Negotiate

The collection agency for landlords may also attempt negotiations with the tenants on the landlord’s behalf. For instance, they may accept a lump-sum settlement paid by the tenant if an agreement is reached.

vi. Legal Action

If none of the above methods yield any results, they can escalate to a lawsuit to recover the unpaid dues. During legal proceedings, landlords need to provide sufficient evidence regarding the validity of the unpaid rent, with supporting evidence of collection efforts and a reasonable grace period.

However, pursuing a legal course may be a costlier approach. In fact, landlords often benefit more from exploring modern, less aggressive steps before escalating to legal action.

How to Find a Collection Agency for Landlords?

To find a collection agency for landlords, you can use online research to find the best-rated collection agency in your vicinity. You may also seek recommendations from other landlord organizations in your area.

Typically, collection agencies for landlords that specialize in recovering overdue rent may charge approx. 20% to 50% as commission from the recovered amount. This leaves them with 50% of the amount recovered despite professional help. So, before deciding to go to a rent collection agency, it’s best to explore the other routes.

What to Do Before Hiring a Collection Agency for Unpaid Rent

Not every late payment calls for a rent debt collection. Sometimes, tenants fall behind due to short-term hardships. Before escalating to third-party involvement, i.e., hire debt collection agency, you should take a few steps to resolve the unpaid rent. Here’s what you can do for unpaid rent collection while keeping tenant relationships intact and maintaining control:

Scenario 1: If the rent has been late for 1 month

I. Have a Direct Talk with the Tenant

It’s best to start by directly discussing with the tenant the reason behind the late or missed rent payment. Having a direct conversation or communication through written email can help you better understand the circumstances and negotiate a way to recover the pending rent.

II. Offer a Grace Period or Payment Arrangement

Before initiating formal recovery, consider offering:

- A brief grace period, i.e., from 3–5 days up to 30 days (depending on the state regulations).

- A customized payment plan, i.e., unpaid rent repayment in weekly, biweekly, or monthly installments.

- Accept partial payment with a clear timeline for repayment of the remaining balance.

These can help prevent missed rent from turning into a longer-term issue.

Scenario 2: If the rent has been overdue for 30–60 days or more

I. Formal Written Notification of the Outstanding Debt

Once the rent becomes overdue, i.e., unpaid rent for more than 30 days, you should send a formal, written notice to the tenant.

The notice should include the following:

- The total rent amount due

- Specify a due date for repayment

- List any late fees or penalties

- Offer a reasonable window for resolution

This step sets expectations and documents your efforts to resolve the issue fairly. This is also important for future legal action.

II. Offer Payment Plan Options

Some tenants may face temporary hardships, which means they may not be able to pay off the full overdue rent amount at once. Rather than demanding a full payment at once, consider offering structured payment plans. These flexible options can increase the chances of recovering the full amount while showing empathy to tenants.

III. Automated Recovery, Payment Reminders, and Follow-ups

Instead of wasting your time and relying on manual outreach, consider automating your internal debt recovery process before handing the case over to external parties. You can use automated debt recovery technology to send impactful payment reminders and follow-ups.

For instance, automated debt collection software such as Recuvery can help run your collections on autopilot. It sends gentle yet persuasive reminders, flexible payment options, and other tactics to prevent bad debt and encourage tenants to pay at a comfortable pace. These gentle nudges often prompt payment without friction or confrontation. Additionally, this ensures no embarrassment for the tenant and no harm to the landlord’s reputation. Moreover, the recovery rate is much higher than hiring a collection agency for unpaid rent.

Learn How a Debt Collection Software Simplifies Collections

Read Our GuideShould I Consider an Alternative to Using a Rent Collection Agency?

A rent debt collection agency can be costly, and it may not always be the necessary approach. So, before you think about hiring a collection agency for unpaid rent, you may want to explore an alternative option, such as automating the collection process.

Benefits of Using an Automated Debt Recovery System

Instead of jumping straight to collections, tools like Recuvery allow you to:

- Track unpaid rent from multiple tenants through a central dashboard.

- Send regular reminders via email, SMS, or other methods.

- Offer flexible resolutions to pay off the unpaid rent debt.

- Customers can control whether to pay in full, make a partial payment, or choose a flexible payment plan.

- Notify tenants in a timely manner and strategize when escalation is needed.

- Maintain transparency and document everything automatically. It keeps detailed records of every reminder, message, or offer you send to the tenant.

This works as a combo between formal collections and an in-house collection team’s personalized approach. This also helps recover unpaid rent more efficiently and professionally while ensuring ethical collections in accordance with the debt recovery regulations without involving third-party agencies too early.

Rent Debt Collection Agency vs. Using Technology to Streamline the Rent Debt Collection Process

| Criteria | Automated Debt Recovery (i.e., Recuvery) | Rent Debt Collection Agency |

| Cost | Cost-effective | High cost (20%–50% commission) |

| Landlord’s Control | Full control over communications and payment plans | No direct control, the agency manages the process |

| Recovery Approach | Preserves relationship with gentle reminders and flexible payment options | Can strain tenant relationships due to aggressive recovery methods |

| Time & Effort | Minimal supervision, runs on automation with pre-scheduled reminders and follow-ups | Time-consuming to coordinate and monitor |

| Speed of Recovery | Faster resolution with early intervention | Relatively slower process |

| Transparency & Documentation | Automatically maintains records of every interaction | Depends on agency; may not provide full communication history |

| Compliance with FDCPA | Built-in compliance with fair debt practices | Varies by agency; risk of unethical practices |

| Flexible Payment Plans | Yes. Tenants can choose to make partial payments or flexible payment plans | Limited or no flexibility in payment structure |

| Reputation | Maintains a professional and friendly image | May negatively impact landlord’s reputation due to unethical or aggressive practices |

Manually running the collections or hiring an external debt collection agency for unpaid rent collection may be counterintuitive, as they require more money, time, and resources for recovery. So, you can reduce the cost of recovery by automating the collection process with debt recovery technology like Recuvery.

Bottom Line

A rent collection agency can perform as a key intermediary between landlords and tenants when it comes to rent debt collection. However, this is usually a more aggressive route, whereas there are also other ways that may be more cost-effective with a higher recovery rate, such as automating your rent debt collection process with tools such as Recuvery. Automating the recovery process helps ensure steady cash flow, avoid financial disruptions, and alleviate the stress of chasing outstanding rent payments.

This approach can also strengthen your case if further action is necessary and shows a good-faith effort to resolve the issue without external pressure. Furthermore, it helps keep clear records of all communications that can serve as critical evidence if you decide to pursue legal action later.

Unpaid Rent Collection Agency FAQs

1. How Can I Recover Outstanding Rent From a Tenant?

There are seven ways to recover outstanding rent from a tenant:

- You can discuss with them directly and reach an agreement

- Give them a grace period to pay

- Send them a formal written notification or demand letter

- Negotiate a payment plan arrangement

- Automate debt recovery with software

- Hire a rent debt collection agency

- Pursue legal options (if necessary)

2. Can a Past Due Rent Collection Agency Help with Tenants Who Left Without Notice?

Yes. If the tenants abandoned the property without notice and moved out without paying rent, you may send the account to a rent debt collection agency. You need to wait until after the reasonable grace period ends (as per your state regulations).

3. Can Landlord Send Unpaid Rent to Collections?

Yes, if the rent is past due for 30–90 days, the landlord can send the account to a past-due rent collection agency.

4. How Much Is a Reasonable Grace Period in Different States?

3–5 days is the reasonable grace period in most states in the US, though it may differ in each state. For instance, Texas has a shorter grace period of 2 days. However, states like Delaware, Kentucky, New York, North Carolina, Oregon, New Jersey, and Tennessee allow a 3-5 day grace period. Connecticut allows a 9-day grace period for monthly leases and a 4-day grace period for weekly leases. Maine offers a 15-day grace period. Whereas Massachusetts has a 30-day grace period. It is crucial to note that grace periods may be different for certain protected classes.

5. Is Unpaid Rent Collection Possible After Several Months Have Passed?

Yes, it is possible if the statute of limitations on overdue rent collection has not expired. For instance, 3 to 6 years is the common statute of limitation in most states, while it can be up to 10 years in some states. So if the debt is still within the limit, you can take legal action to pursue the claim.

6. Can Landlords Do Rent Collection Themselves?

Yes. If you don’t want to spend money on a third-party collection agency, you can always choose to invest in automated debt collection software such as Recuvery. This allows you to run your entire debt collection process on automation. This way, your customers can easily choose whether they prefer to pay in full, partially, or set up a flexible plan and pay off debt at a more convenient pace.

7. What to Look for When Using a Rent Debt Collection Agency?

Make sure the collection agency you choose is legally compliant. Hire a licensed collection agency that specializes in unpaid rent collection. Make sure to read the collection contract and discuss the commission share agreement upfront to avoid any problems later. It is also recommended to monitor that the agency is using legal and ethical methods for recovery. If the agency uses an aggressive approach and harassment, it can also affect the landlord’s reputation.

8. How Much Does Hiring a Collection Agency for Unpaid Rent Cost?

A collection agency typically charges 20% to 50% as commissions on the recovered amount. However, actual costs may vary depending on the specific state regulations, the amount owed, and the complexity of the case. Instead, automating your collection process can be a more cost-effective approach.

9. When Should I Hire a Debt Collection Agency for Rental Income?

Landlords can hire a debt collection agency for unpaid rent recovery from tenants with overdue rent for 30–90 days past the due date. However, before taking the drastic step, landlords need to follow the procedure and try all the other rent debt recovery methods before going to a collection agency.

10. Can Collection Agencies for Landlords Report the Outstanding Debt To Credit Bureau?

Yes. Collection agencies report the overdue rent debt to the major credit bureaus on behalf of the landlord if the tenant refuses to pay.