How to Write Past Due Invoice Email Templates That Work (With Examples)

Cash flow is the lifeline of any business. It keeps operations running, ensures financial stability, and fuels long-term growth. But when payments are delayed or missed, this flow is disrupted, impacting everything from daily expenses to strategic decisions.

One of the most common causes of cash flow disruptions is past due invoices. Customers who delay payments, whether intentionally or unintentionally, can put businesses in a difficult position. That’s why having a system in place to follow up is crucial.

A simple yet effective solution is sending past-due invoice emails. These timely, professional reminders not only help businesses recover outstanding payments but also maintain healthy client relationships. With the right tone and structure, a past-due invoice email template can save time, reduce awkwardness, and improve your chances of getting paid faster.

What Is a Past Due Invoice Email?

An email for past due invoices is a polite reminder sent to a customer or client when an invoice remains unpaid beyond its due date. Its primary goal is to prompt the customer to clear the outstanding balance while maintaining a professional and respectful relationship.

The tone of this email is important. It is advisable to keep it motivating and encouraging, as many overdue payments happen simply because a client forgot or overlooked the due date. A well-crafted past-due invoice email template acts as a gentle nudge to settle the payment without creating unnecessary tension.

At the same time, your business depends on timely payments to keep cash flow steady. That’s why these emails should strike the right balance between urgency and politeness. They serve as the middle step before more formal measures, such as sending a dunning notice or involving collections.

Did You Know?

Research by Small Business Insight reveals that small businesses in the U.S. receive payment an average of 8.2 days after the due date.

How to Write a Past Due Invoice Email?

As explained above, a past-due invoices email should be polite, especially the initial ones. By doing so, you give your clients the benefit of the doubt while keeping your point across. Here are a few tips to do it right:

▪ Be Polite, but Be Professional

Start your email on a courteous note. Acknowledge that delays can happen and frame your message as a friendly reminder rather than an accusation. This sets the right tone and keeps communication respectful.

▪ Explain How They Can Pay

Once you’ve pointed out the overdue payment, provide clear instructions on how customers can settle their dues. Whether it’s via bank transfer, credit card, or an online payment portal, clarity removes friction and makes it easier for them to act quickly.

▪ Be Clear About the Consequences

This is the driving factor to ensure timely payment. When drafting your past-due invoice template, specify what will happen if the invoice remains unpaid, for example, adding late fees, suspending services, or escalating to collections. Keep it firm but professional so the urgency is understood without straining the client relationship.

Learn to Write Powerful Collection Letters That Drive Faster Payments

Read Our GuideWhat to Include in Past Due Invoice Emails?

Now that you have understood the tone, it is essential to know what to include in it. To put it simply, your client should be able to understand the intent of the email from the get-go. That is why it is crucial to include all the details pertaining to the overdue email in a simple and easy-to-read manner.

To achieve this, make sure your email includes the following elements:

➮ A Clear Subject Line

Example: “Friendly Reminder: Invoice #INVNO Past Due”

A straightforward subject with the invoice number helps your client immediately understand the purpose of the email.

➮ Invoice Details

Include invoice number, issue date, due date, and the outstanding amount. This removes any confusion and ensures the client knows exactly which invoice you’re referring to.

➮ Polite Reminder Message

Keep the tone professional, polite, and encouraging. Assume the client may have simply forgotten, and frame your email as a gentle nudge.

➮ Payment Instructions

Provide a direct link or clear instructions for how the payment can be made. The easier you make it, the faster you’re likely to get paid.

➮ Deadline for Payment

Set a specific date by which you expect the payment. This communicates urgency without being overly aggressive.

➮ Contact Information

Share your contact details or the accounting team’s email in case the client has questions or issues with the invoice.

➮ Optional: Consequences of non-payment

In later reminders (not the first one), mention possible late fees, service suspension, or escalation to collections if payment is not received.

Past Due Invoice Email Examples

Here are a few past due invoice email samples to keep in handy when you are sending out reminders.

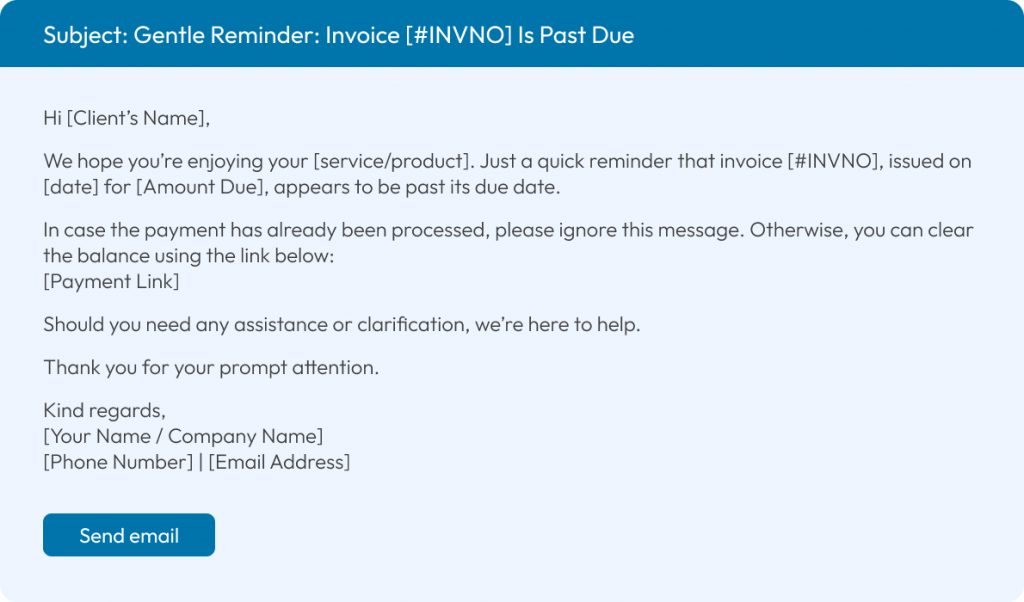

1. Friendly Reminder Email (1–7 Days Past Due)

At this stage, you should assume the missed payment was an oversight. The goal is to send a gentle nudge.

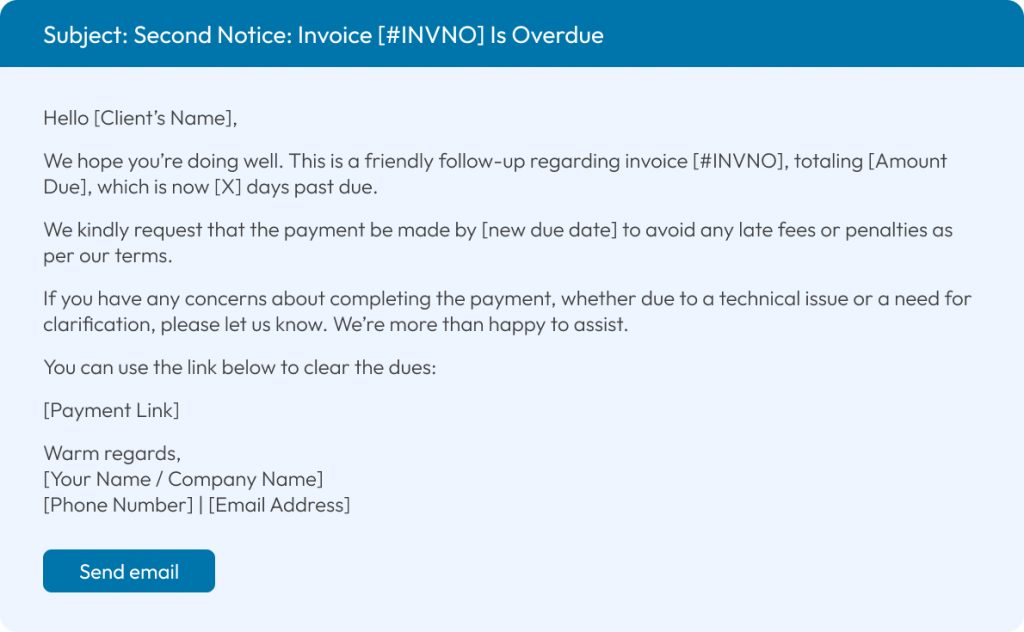

2. Second Reminder Email (8–14 Days Past Due)

Here, your tone can be slightly firmer, but still respectful. The goal is to remind them again while gently emphasizing the importance of settling the payment.

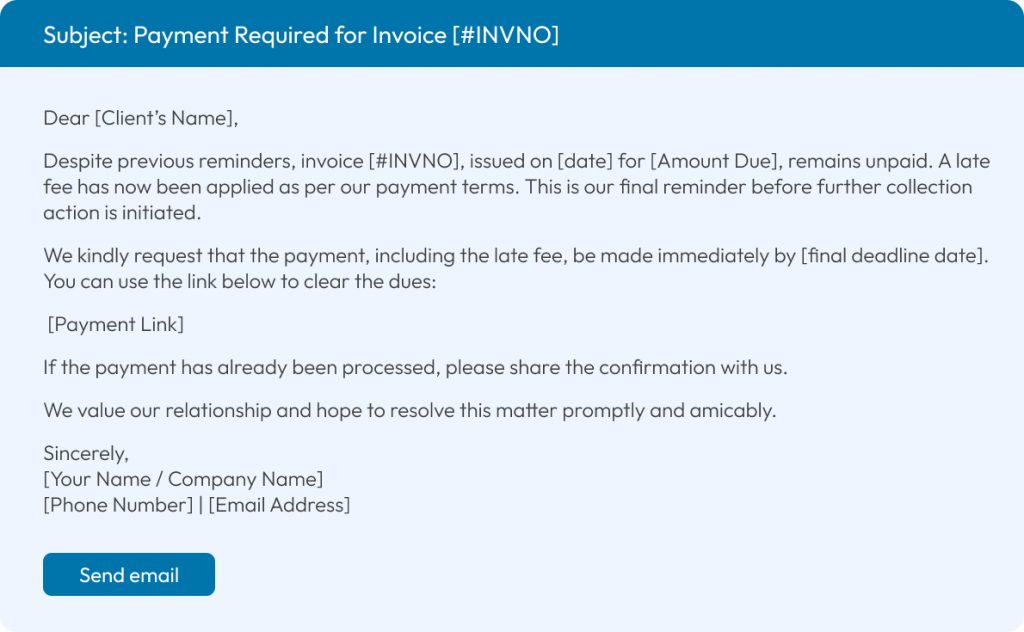

3. Final Notice Email (15+ Days Past Due)

Since the payment is more than 15 days overdue, the tone can get firmer to reflect the seriousness of the situation while remaining professional.

Note: Make sure to customize these email templates based on your industry type and client relationships.

Best Practices for Past Due Invoice Emails

- Keep the Tone Courteous and Encouraging: Always maintain a non-threatening, polite tone. Remind your clients in a way that motivates them to pay without creating friction.

- Customize for Different Types of Clients: Tailor your past due invoice emails depending on the client’s value and relationship with your business. High-value clients may need a more personal touch, while standard templates can work for others.

- Space out Your Reminders: There’s no strict rule for timing, but avoid sending multiple reminders too close together. Space them evenly to stay professional without overwhelming your clients.

- Offer Assistance if Needed: Sometimes delays happen due to confusion or technical issues. Let clients know they can reach out if they need help or clarification.

- Automate the Process: Use tools that let you streamline your collections process, or better still, handle every aspect of it!

Did You Know?

14% of small to medium-sized businesses spend five or more hours a week just trying to get paid.

Recover Overdue Payments Easily with Recuvery

Chasing late payments shouldn’t drain your time or energy. With Recuvery by your side, you can spend this time growing your business instead.

Simply upload or sync your overdue accounts, and the platform takes over from there.

Your customers receive polite, branded reminders automatically, and can clear their dues with flexible repayment options via web or mobile app. You get faster payments without awkward follow-ups, while your clients get a seamless and respectful repayment experience.

Everyone wins — and you get your cash flow back on track.

Conclusion

Maintaining a steady cash flow is essential for any business, and overdue payments shouldn’t be left to chance. While delays happen, a structured follow-up system using well-written past due invoice emails can make all the difference.

With the right templates in place, you can send reminders confidently, without coming across as aggressive or unprofessional. Just remember to customize your tone based on the client, space your follow-ups strategically, and offer support when needed.

When done right, past due invoice emails don’t just recover payments, they reinforce trust and set the tone for professional accountability in future transactions.

Tired of Chasing Late Invoices?

Simplify Follow-Ups and Get Paid Faster with Recuvery

Schedule a Demo Today!FAQs

1. What Is a Collection Email for Past Due Invoices?

A collection email for past due invoices is sent when initial reminders haven’t resulted in payment. It’s firmer than a friendly reminder but still maintains a professional tone.

2. How Do I Create a Past Due Invoice Letter Template?

A past due invoice letter template should include the invoice details, amount due, payment options, deadlines, and consequences for non-payment. Templates save time and ensure consistent messaging.

3. When Should I Send the First Past-Due Invoice Email?

Ideally, send the first reminder 1–3 days after the due date. A gentle follow-up early on prevents delays from turning into long-term outstanding balances.

4. How Many Past-Due Invoice Emails Should I Send Before Escalating?

Typically, 2–3 reminders are sufficient. If there’s still no response, you can send a final notice or escalate to collections, depending on your policy.

5. Can I Charge a Late Fee on Past Due Invoices?

Yes — if your contract or payment terms mention it. Clearly state the late fee in your reminder so the client is aware.

6. What if a Client Still Doesn’t Respond to Past Due Invoice Emails?

If reminders are ignored, follow up with a phone call, send a formal letter, or escalate to collections, depending on your internal policy.