What Is Small Business Debt Recovery: A Comprehensive Guide

Small business debt recovery refers to the process of collecting outstanding payments owed to a business by its customers or clients for goods or services that have already been provided. When customers fail to pay within the agreed timeframe, these unpaid invoices become overdue, leading to potential cash flow disruptions. Consequently, this can affect a business’s profitability, hinder growth, and strain day-to-day operations.

To deal with overdue payments, many rely on a small business debt collection agency. Indeed, these services take a structured and strategic approach to recover the amount owed. However, businesses can use debt collection software too.

In this blog, we’ll break down everything you need to know—how debt recovery works, smart collection strategies, and how software can streamline the process.

But first things first, let’s understand the common setbacks that unpaid invoices can cause.

In 2023, over half (55%) of U.S. B2B sales were paid past due, and 81% of companies reported increasing payment delays. On average, it took 49 days to get paid.

How Overdue Payments Disrupt Small Business Success

Debts may seem like small bumps at first, but they can turn into serious roadblocks for small businesses. Here’s how they cause trouble:

➤ Cash Flow Disruption

When customers don’t pay on time, the business may struggle to cover its basic expenses like rent, staff salaries, bills, and inventory. Eventually, this affects daily operations and puts the business in a tight financial spot.

➤ Slow Business Growth

With limited funds coming in, it becomes harder to expand services. As a result, the business may lose its competitive edge and miss out on growth opportunities.

➤ Increase in Stress and Burnout

Instead of focusing on growing the business, owners end up spending too much time on recovering overdue payments. Therefore, this constant pressure can lead to frustration, exhaustion, and poor decision-making.

➤ Damaged Customer Relationships

Frequent reminders can upset customers. As communication becomes tense, some clients may stop working with the business altogether.

➤ More Spending on Collections

The longer debts go unpaid, the harder and more expensive they are to recover. You may need to spend extra time or hire outside help, which increases costs.

➤ Poor Financial Planning

Unpaid debts create unpredictable cash flow. And when you don’t know when the money will come in, it becomes difficult to plan ahead, budget properly, or prepare for new opportunities.

Unpaid invoices create a chain reaction that affects every part of your business. That’s why it’s important to manage them early and have a clear debt recovery plan in place.

Why Small Business Debt Recovery Matters

It is not limited to just getting paid. It’s about sustaining operations, protecting profitability, and enabling growth. When customers fail to pay on time, the consequences can ripple across every part of a small business. Therefore, having an effective debt recovery for businesses in place is critical.

♦ Maintains Healthy Cash Flow

Small business debt recovery helps make sure money keeps coming in. Small businesses often have tight budgets and need regular payments to cover daily expenses like rent, employee wages, inventory, and utility bills.

♦ Protects Profit Margins

Unpaid invoices mean the business is losing money. By recovering unpaid debts, businesses can protect the money they’ve already earned.

♦ Promotes Financial Discipline (Internally and Externally)

An organized approach to debt recovery shows that the business takes payment seriously. As a result, customers are more likely to respect payment terms.

♦ Saves Time and Resources

Delaying collection efforts often makes it more difficult to get the money back. Therefore, addressing debts early reduces the need for lengthy disputes or legal actions later.

♦ Strengthens Business Stability and Growth

Recovering debt on time helps the business stay financially stable. It gives the business the resources to grow. In turn, this helps the business stay competitive and strong in the long run.

Now that you understand why small business debt recovery is important, let’s explore how the process works.

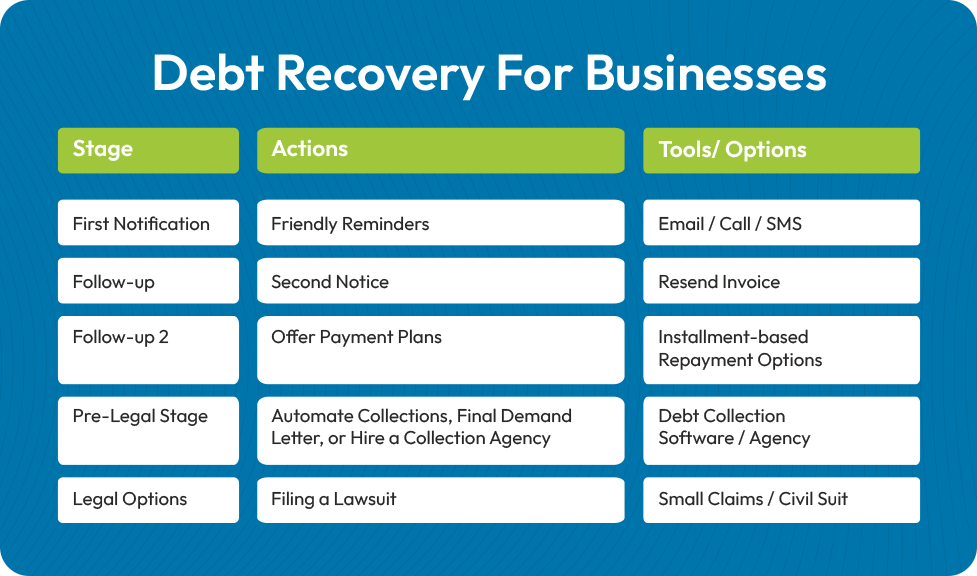

Step-by-Step Guide to Small Business Debt Recovery

Having a structured debt recovery process helps small businesses recover money efficiently while protecting customer relationships. Here’s the detailed process of small business debt recovery.

I. Friendly Reminder (Initial Stage)

If a customer misses a payment, the first step is to send a polite reminder.

- This can be done through email, phone call, or even a text.

- Keep the tone friendly and professional.

- Include the invoice number, due date, and amount owed.

II. Follow-Up Notice

If there’s no response within a few days, follow up with a second, firmer message.

- Be clear about how long the payment has been overdue.

- Reattach the invoice and request immediate action.

III. Offer Flexible Payment Options

Try offering flexile payment plans if customers are facing financial difficulties.

- Break the full amount into smaller installments.

- Agree on a timeline in writing.

IV. Pre-Legal Stage

This stage includes:

a) Debt Collection with Automation

Overdue debt recovery doesn’t always require legal action. So before escalating to court involvement, consider automating your debt recovery process using debt collection software such as Recuvery. The automated system saves time and energy by automating reminders, follow-ups, and associated collection efforts. It also offers convenient payment options to encourage repayment. In fact, businesses using automated collections recover overdue payments 35% faster and have higher recovery rates.

b) Final Demand Letter

If reminders and payment plans don’t work, it’s time to escalate the matter professionally, but still without legal action. Send a formal letter stating the total amount due, the new deadline, and the consequences of non-payment. Moreover, use a serious but professional tone.

c) Engage a Debt Collection Agency

At this point, many small businesses turn to debt collection agencies for help. These professionals are trained to:

- Contact the debtor repeatedly using proper legal methods.

- Negotiate payments or settlements.

- Report non-payment to credit bureaus if needed.

- Sometimes charge a fee or a percentage of the amount recovered.

V. Legal Stage (Last Resort)

Finally, if all previous efforts—including help from a collection agency—fail, the business can pursue legal action. This step can include:

- Filing a claim in small claims court or civil court.

- Getting a court judgment that legally requires the customer to pay.

- In some cases, seizing assets or garnishing wages (through proper legal channels).

Discover Top Debt Recovery Solutions for Small Businesses

Explore NowBest Practices for Debt Recovery for Businesses

Here are some smart and practical strategies that can help businesses collect what they’re owed while keeping relationships intact.

✦ Set Clear Payment Terms from the Start

Make sure customers know your payment rules. Clearly mention due dates, penalties for late payments, and accepted payment methods.

✦ Send Timely and Polite Reminders

Don’t wait too long to follow up. Send a friendly reminder a few days before the due date. If the payment is late, follow up with a firmer (but still polite) message.

✦ Offer Flexible Payment Plans

Sometimes, customers may want to pay but can’t afford the full amount. Offering installment options or flexible payment plans can make it easier for them, and businesses can recover the money, even if it takes longer.

✦ Use Incentives for Early Payments

To encourage timely payments, offer small discounts for early or on-time payments. For instance, 2% off if paid within 7 days.

✦ Have a Structured Follow-Up Process

In case the payment is still delayed, create a system for reminders:

Day 1: Gentle reminder

Day 7: Firm reminder

Day 14: Final notice

After that, consider taking legal action.

If all else fails, bring in the professionals. Debt collection agencies specialize in recovering unpaid debts. It saves your time and often increases your chances of success.

Yet, there’s always that one pressing question on everyone’s mind.

Are Collection Agencies for Small Businesses Worth the Cost?

For many small businesses, yes, collection agencies can be worth the cost. Especially when internal efforts to recover unpaid invoices aren’t working. However, most agencies charge a percentage of the recovered amount, typically ranging from 20% to 50%. For smaller debts, the cost may outweigh the benefit. After all, no one likes paying extra just to retrieve their own money. That’s why it’s important to factor in the size of the unpaid amount before choosing a small business debt recovery approach.

There’s Also a Better Way—Debt Collection Software for Small Business

Debt collection software is a digital tool that helps businesses manage and recover unpaid invoices more efficiently. Instead of tracking overdue accounts manually, this software automates the process. Consequently, saving time, reducing stress, and improving recovery rates.

Small Business Debt Collection Agency vs Debt Collection Software

| Feature | Debt Collection Agency | Debt Collection Software |

| What it is | Third-party recovery service | Automated tool for in-house collections |

| Control | No direct control, everything is handled by the agency | You stay in full control |

| Cost | 20%–50% of the recovered amount as commission | Cost-Effective |

| Tone & relationship | May use aggressive tactics that may damage your business reputation | Persuasive yet friendly messaging—maintains better customer relationships |

| Best for | When other collection tactics have failed | Ongoing account management and recovering large or old unpaid debts |

| Effort required | Minimal effort from your side | Automated process, minimal supervision and monitoring required |

| Speed of Action | Slower recovery process, especially for tough cases | Steady, proactive follow-ups and faster recovery |

Our take: Embrace debt collection software and…

Put Debt Collection on Autopilot

How, you ask?

Enter Recuvery. It combines intelligent automation with human understanding, so you can collect your unpaid invoices. All you need to do is upload your unpaid accounts. Recuvery will handle everything, making your debt collection quicker and more reliable.

How Recuvery Is Best for Small Business Debt Collection?

- Sends friendly, on-brand reminders that feel like part of your regular communication

- Offers customizable, flexible payment plans, so your customers can catch up without stress

- Ensures every message is 100% compliant, protecting your business from legal risk

- Automatically reports unpaid debts to all three credit bureaus, creating a sense of urgency

- Gives you real-time tools to manage collections quickly and professionally

And with Recuvery’s built-in invoicing system, you can track payments, set up auto-reminders, and stay in control—all in one place. Because the more organized your payment process is, the less time you’ll spend chasing unpaid bills, and the faster you’ll get paid.

The Final Words

Unpaid invoices can slow down a business and make it harder to grow. But by choosing small business debt recovery, companies can avoid this hassle. Even better, using software like Recuvery to automate debt collections makes managing payments faster and easier.

FAQs

1. How Does a Small Business Debt Collection Agency Differ From Debt Collection Software?

A small business debt collection agency is a third-party service that actively pursues overdue payments on your behalf, often charging a percentage of the recovered amount. In contrast, debt collection software helps you manage collections internally, keeping you in control.

2. What Is Small Business Debt Recovery?

Debt recovery for small businesses means collecting payments that are overdue. It ensures steady cash flow, reduces financial stress, and prevents revenue loss.

3. How Collection Agency for Small Businesses Work?

Collection agencies work by contacting customers on behalf of the business to recover unpaid debts. They use phone calls, emails, letters, and even legal action to collect the amount owed.

4. What Is the 7 in 7 Rule for Collections?

The 7 in 7 rule for collections is a guideline set by the Consumer Financial Protection Bureau (CFPB) in the U.S. under the Debt Collection Rule. It means a debt collector cannot call a consumer more than 7 times within 7 consecutive days about a specific debt.