Average Collection Period

What Is Average Collection Period (ACP)?

The ‘Average Collection Period’ is a key metric that tells how long it takes businesses to receive payments for rendering their services. Or, in simpler words, it's the gap between delivering services and the cash receipt.

Knowing average collection days, i.e., how long it takes a business to get paid, is crucial for financial planning and forecasting. A longer collection period (i.e. 60+ days) implies less liquidity in the short term, i.e., slower cash flow. However, a shorter collection period (i.e., <30 days) means seamless cash flow and better liquidity for the business to meet its financial obligations.

Hence, a quicker average collection period = financial stability and builds a sound financial resilience foundation for the business.

How to Calculate Average Collection Period?

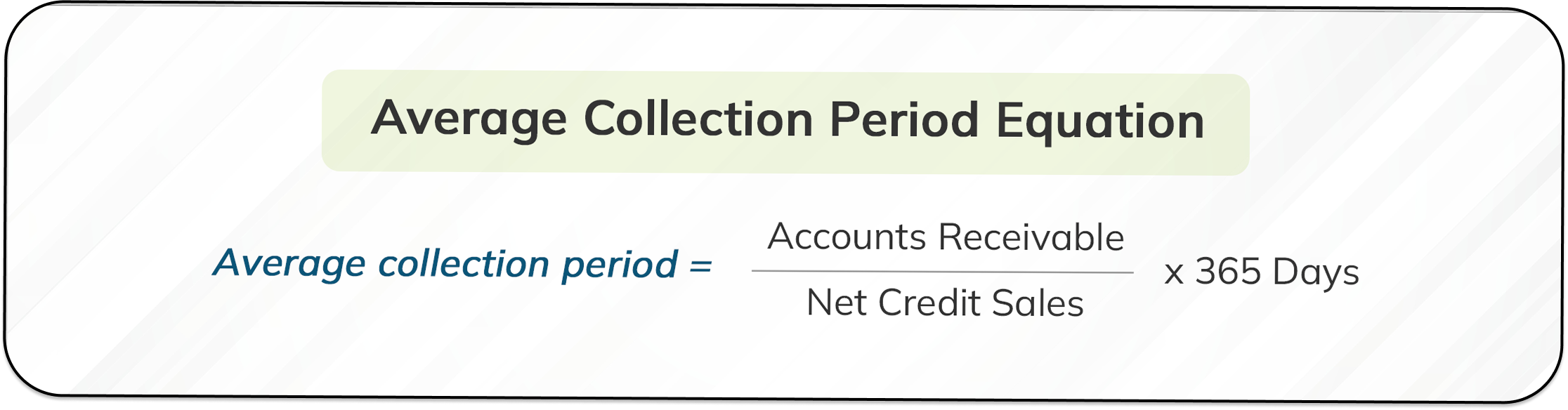

The Average Collection Period Formula Is:

Accounts Receivable ÷ Net Credit Sales × 365 Days = Average Collection Period

Explanation: For calculating average collection period, start by dividing the (Accounts Receivable Amount ÷ Net Credit Sales), and the resulting figure is multiplied by the days in a year (× 365 Days), which provides the number of days it takes for a business to expect cash flow after sale conversions.

Understanding Average Collection Period Calculation with Examples

Example 1:

Let’s take an easy example: say your company’s Accounts Receivable are $10,000 and the total sales you’ve made are around $100,000 (i.e., ‘Net Credit Sales’ amount).

Here’s how we’ll calculate the Average Collection Period:

We’ll use the formula:

Accounts Receivable/Net Credit Sales x 365

Now, we’ll break it down step by step:

$10,000/$100,000 = 0.1 x 365 = 36.5 Days

Hence, 36.5 days is the average collection period for the business.

To further drive comparative analysis of whether this is a good thing or not, we can compare this with the ACP of previous years.

Example 2:

For instance, let’s say the year before this, your Accounts Receivable amounted to $22,000, and the Net Credit Sales were around $200,000. So, let’s calculate the previous year’s ACP.

Let’s again apply the same average collection period equation:

Accounts Receivable/Net Credit Sales x 365

So,

$22,000/$200,000 = 0.11 x 365 = 40.15 Days

Hence, the average collection period for the previous year was 40.15 days.

This finding signifies that this year’s average collection period, i.e., 36.5 days, is less than the 40.15-day average collection period of the previous year. Hence, this implies that the cash inflow is 3.65 days faster (40.15 days – 36.5 days) than the previous year.

However, while this is an improvement, a <30-day period is considered ideal for efficient cash flow. Hence, collection processes can be further enhanced. It can be done by employing automated debt collection software such as Recuvery or other tools. This can help eliminate redundant processes and speed up the collection rates and efficiency without any manual hassle.

Why Is the Calculation of Average Collection Period Important?

The average collection period calculation is imperative for the following reasons:

➮ Measuring Cash Flow Efficiency

An average collection period calculator tells you how quickly your company collects cash from customers after a sale. So, if the collection period is shorter, it means faster cash inflows and better liquidity for your business. It is crucial to ensure uninterrupted and predictable finances for the business.

➮ Financing Options’ Effectiveness

The average collection period applies to the credit sales, which means that the business may have a system to finance customers or an in-house system to collect the payments. So, if the average collection period is long, that means they need to rethink their financing solutions and explore other payment options that can reduce this gap and bring stable revenue in the short term.

➮ Effectiveness of Accounts Receivable Management

For a healthy cash flow and financial stability, efficient accounts receivable management is crucial. Calculation of average collection period helps measure how the accounts receivable policies are impacting the company's financial health and if any adjustments are needed.

➮ Impact Operational Expenses Management

ACP also helps businesses understand the timing of cash availability to fund daily operations. A lower average collection period improves short-term financial flexibility. On the other hand, a longer ACP may indicate issues with the collection process and potentially impact a company's financial health.

➮ Insights on Customer Payment Behavior

Learning about the average timeline for collections may also highlight the customer payment behavior and trends, such as a persistent need for follow-ups from customers who consistently make late payments. This can highlight the need for a more efficient accounts receivable process.

For instance, integrating an automated debt recovery system that also offers flexible payment options that facilitate timely payments and help speed up the cash inflow.

➮ Helps Identify Liquidity Risks

High outstanding receivables and a longer collection period highlight serious cash flow risks. It signifies reduced immediate cash availability and increases the risk of cash shortfalls for day-to-day business expenses.

➮ Strategic Forecasting & Financial Planning

Calculating average collection period helps predict cash inflow timing more accurately. It is also crucial for making informed decisions on inventory purchases, payroll planning, and capital expenditures.

➮ Comparative Performance Analysis

Average collection period calculation also enables financial analysis and allows comparison against industry averages and past performance. It helps detect trends in collection efficiency—positive or negative—and provides valuable insights for future planning.

➮ Enhances Investor and Stakeholder Confidence

Strong receivables management shows sound financial practices in place and stable cash flow. This helps build trust among external stakeholders regarding the financial reliability of the company.

FAQs

1. How to Calculate Average Debtors Collection Period?

The average debtors collection period formula is the same: Accounts Receivable/Annual Net Sales x 365 days.

2. Is a High or Low Average Collection Period Better?

A low collection period, such as less than 30 days, is considered to be better, as this indicates that the business receives payments within 30 days. However, a longer collection period can cause financial delays, which can also disrupt financial operations for the business.

3. Why Is a Lower Average Collection Period Better?

A lower average collection period is considered better because it means higher collection efficiency. However, a very low collection period can also be viewed negatively, as it may reflect stricter credit terms for customers. Hence, this may discourage customers from choosing the business. Hence, a 30-day collection period is considered to be most favorable.