Recuvery Flow – Where Automation Meets Debt Collection

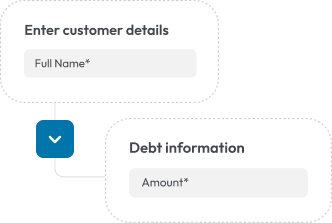

Recuvery makes collections simple in three steps. It starts the moment you upload your overdue accounts.

Enter

Give Recuvery the data for all your past-due accounts, and it will handle everything from there.

Send

With friendly, ready-to-send reminders across key channels, we’ll make sure you see faster, more reliable payments.

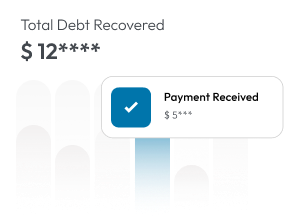

Get Paid

This isn’t just about saving time—it’s about transforming your entire debt collection process to ensure more reliable payments.

With clear dashboard visibility, quick uploads, and smart follow-ups, your collections run smoother from day one.

Core Offerings Overview

Payment Plans – Flexibility that Encourages Repayment

Recuvery enables your business to offer structured, flexible payment plans that support your customers’ ability to repay without added pressure.

These plans can be customized based on financial circumstances, helping customers stay engaged and consistent with their obligations. The software allows for seamless setup, tracking, and management—all from a single interface.

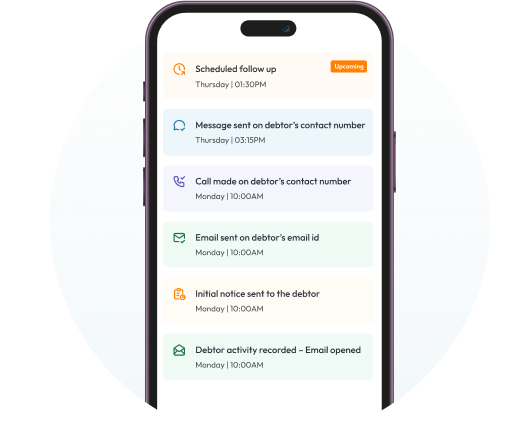

Automated Follow-Ups to Drive Consistent Engagement

Recuvery automates the follow-up process by sending reminders to customers at predefined intervals, triggered by account status or payment activity.

This eliminates the need for manual outreach while ensuring that no account falls through the cracks. All follow-ups are professional, timed appropriately, and delivered across multiple communication channels, including email, SMS, and in-app notifications.

AI-Driven Account Prioritization for Smarter Collection Strategy

Recuvery uses intelligent algorithms to analyze customer payment behavior, account history, and risk indicators to identify which accounts require immediate attention.

This allows your team to focus on high-priority cases and deploy the right strategy for each situation.

Automated Collection Letters with Compliance and Consistency

Recuvery automates the process of generating and sending collection letters. It removes the need for manual drafting while ensuring consistent tone, timing, and regulatory compliance.

These letters are sent according to customizable rules and are formatted to meet legal standards. This helps your business remain compliant without dedicating additional resources.

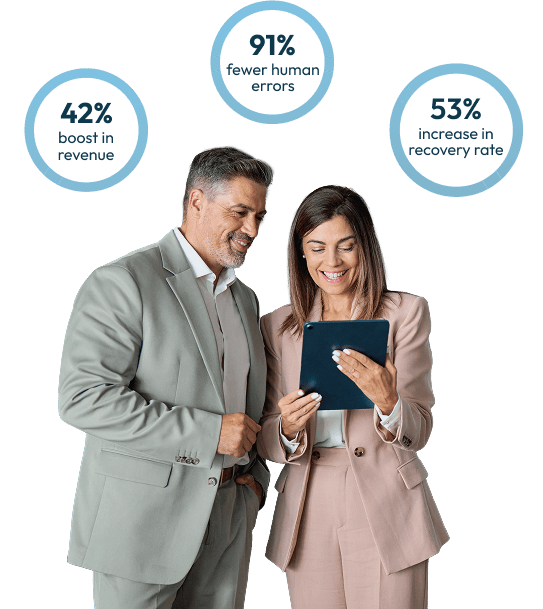

Improved Cash Flow Through Timely, Predictable Collections

Recuvery enhances cash flow by accelerating the speed at which overdue accounts are recovered. With automated workflows, timely outreach, flexible payment options, and real-time tracking, your collections process becomes more predictable and efficient.

Reduced Human Error Through Intelligent Automation

Manual data entry and repetitive tasks increase the likelihood of mistakes, especially in high-volume operations. Recuvery minimizes these risks through intelligent automation that handles routine processes with precision and consistency.

From generating payment reminders to documenting communications, every step is streamlined to maintain accuracy and reduce operational risk.

Built for Trust. Backed by Compliance.

Compliance First – Stay Secure, Stay Protected

Recuvery is engineered with built-in compliance safeguards to help your business confidently meet all relevant regulatory obligations

Every communication, transaction, and customer interaction is automatically recorded and securely stored—ensuring full transparency. For businesses operating in regulated sectors such as healthcare, finance, or education, this level of protection is essential.

Credit Bureau Reporting That Strengthens Collection Leverage

Recuvery allows your business to report account statuses directly to all three major credit bureaus. This reporting capability adds a layer of accountability for customers and encourages timely payments.

Maintaining accurate credit reporting also helps your business align with industry standards and promotes a more responsible payment culture among customers.

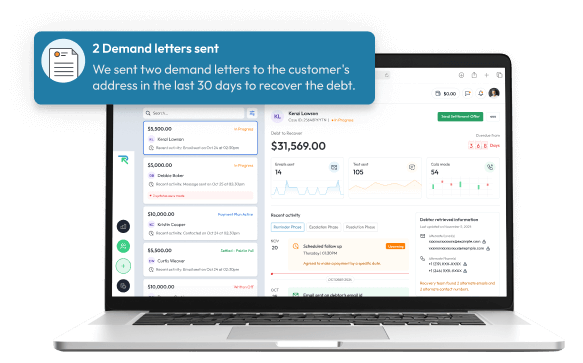

Real-Time Access and Operational Control

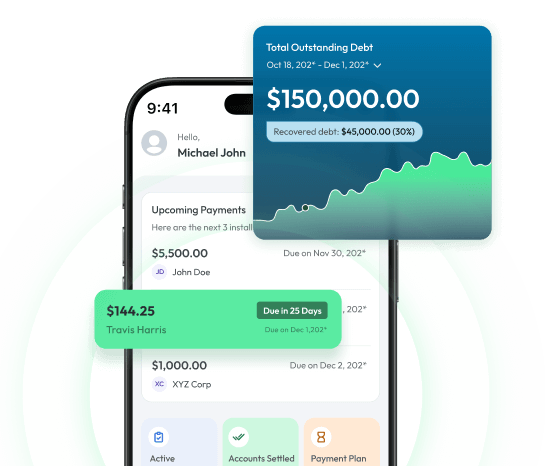

Recuvery offers full, uninterrupted access to your collections dashboard from any device, at any time. This ensures that your team has continuous visibility into account performance, payment history, and communication logs.

With all critical data centralized and updated in real-time, your staff can act quickly, identify issues early, and optimize recovery strategies without delay.

Branding Support Across All Customer Communications

Recuvery enables your organization to maintain a cohesive and professional brand identity across all customer communication channels.

Whether it is a collection letter, an email reminder, an SMS notification, or an in-app message, every customer touchpoint can reflect your brand’s tone, values, and visual style.

Clear and Transparent Pricing Structure

Recuvery’s pricing is designed for clarity, predictability, and value. Businesses are charged a single, transparent fee that covers all essential services, with no hidden charges or commissions.

Whether you manage a small number of accounts or operate at an enterprise scale, the pricing structure remains consistent and easy to plan around.

Platform Demonstration Before Onboarding

Recuvery provides a comprehensive demonstration of the platform before onboarding, allowing your team to fully understand how the system works in real-world scenarios.

This demonstration includes a detailed overview of the web dashboard, mobile app functionality, automation flows, compliance tools, and analytics reporting. We ensure that key decision-makers can evaluate the platform’s features concerning your specific business processes.

Made to Scale. Crafted for Control.

Seamless Integrations – Connect and Recover Effortlessly

Recuvery integrates directly with your existing CRM or accounting software. It enables efficient data flow without disrupting your current systems.

Whether you're managing collections in-house or across multiple departments, Recuvery adapts to your workflow, improves efficiency, and allows your teams to act quickly with accurate, up-to-date information.

Scalability & Reporting – Built for Growth

Whether you're managing 10 accounts or 1000, Recuvery scales with your needs. The software continuously tracks and updates every account in real time, offering visibility into recovery rates, outstanding balances, and overall cash flow performance.

Advanced reporting tools allow your team to identify trends, analyze performance, and make informed adjustments to strategy.

Custom Mobile App for Your Business

Recuvery equips your business with a custom mobile application to modernize and streamline the debt recovery process.

This app is built specifically for your organization. For internal teams, the app provides real-time access to account activity, making it easier to manage collections while away from the desk.

Comprehensive Analytics and Reporting for Operational Clarity

Recuvery provides a centralized dashboard with real-time reporting tools that deliver detailed insights into every aspect of your collections process.

You can monitor recovery rates, overdue balances, customer engagement trends, and cash flow performance—all in one place.

Why Businesses Choose Recuvery – A Smarter Way to Collect

Faster payments. Stronger customer relationships. Less time wasted on manual tasks.

That’s why businesses trust Recuvery.

You get a platform that automates your collections, keeps everything compliant, and treats your customers with respect.