Aging Report Explained: How To Use It To Improve Collections and Cash Flow

If your business is like most others, you’ve got a handful of customers who always pay late, and a few who’ve completely ghosted you. This is why your business’s cash flow is silently taking the hit. Whether you run a healthcare business, a creative agency, or a software firm, delayed payments can hinder your business growth.

A 2023 survey found that 81% of businesses reported increased delayed payments. 77% struggle with inefficient AR teams.

Source: PYMNTS

This is where an aging report steps in. An aging report is more than just a spreadsheet; it is your business’s first defense against uncertain cash flow and bad debt. It is a powerful yet underutilized tool that helps you identify which customers are falling behind, how long they’ve been overdue, and what steps you should take next.

This guide delves into the significance of aging reports and why they’re essential for protecting your cash flow. You will also learn about the two key aging methods, an aging report example, and the best platform to act on the data and recover what’s owed.

What Is an Aging Report?

An aging report or accounts receivable aging report is a financial document that lists your unpaid invoices based on how long they’ve been outstanding. It categorizes receivables based on their aging segments, such as:

- 0 to 30 days (current invoices)

- 31-60 days

- 61-90 days

- 91+ days overdue

This time-based breakdown is useful in understanding which customers are paying on time and which accounts are past due. You may think of it as a heat map of your receivables, as it highlights the accounts that may be problematic for your cash flow.

What Aging Report Means Beyond Just a Summary?

Beyond being a simple list of unpaid invoices, an aging report is a cash forecasting tool and risk mitigation strategy. It enables your business to:

- Identify high-risk accounts based on payment behaviour

- Monitor overdue accounts in real time

- Plan action before receivables become unrecoverable

- Improve financial reporting and revenue collection approach

What Does an Aging Report Include?

An aging report includes the following elements:

- Customer Name: The full name of the individual responsible for payment.

- Invoice Number: A unique identifier for each invoice.

- Invoice Date: The original date when the service was delivered and the invoice was issued.

- Due Date: The original payment deadline.

- Invoice Amount: The total amount billed to the customer.

- Aging Segments: Categorized columns demonstrating how long each invoice has been overdue.

- Total Outstanding: The total amount the customer owes, regardless of the invoice issue date.

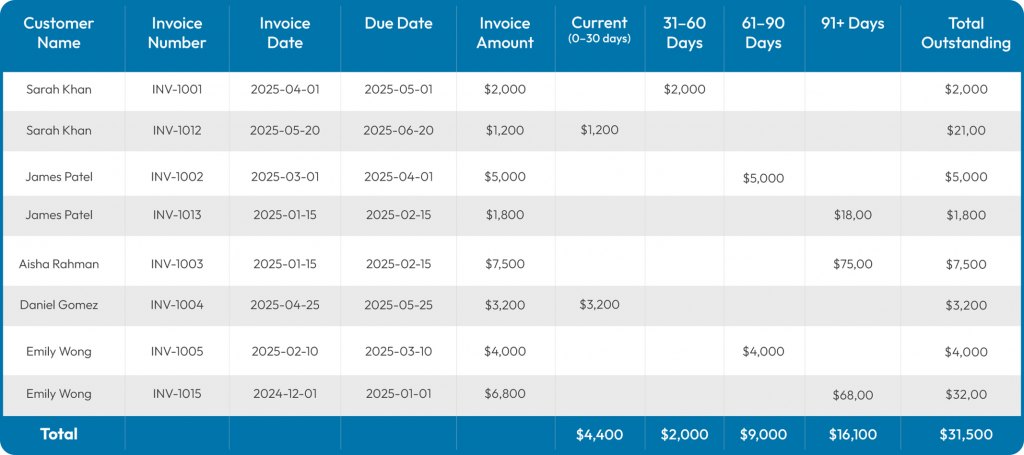

Aging Report Example

Below is an example illustrating a sample aging report that categorizes receivables by overdue periods.

Here are a few examples on how to break down this aging report:

- Sarah Khan has two invoices—one upcoming and another due by 31-60 days.

- James Patel has two overdue invoices—one by 61-90 days and another by more than 91 days.

- Emily Wong owes the highest amount, $10,800, all overdue.

- Aisha Rehman’s $7,500 invoice is long overdue by 91+ days.

How does this aging report format help businesses?

- Knowing the total amounts for each aging bracket helps you focus on priority collections (in this case, specifically the $16,100 overdue by 91+ days).

- This format provides clear insight into each customer’s payment behavior. For instance, James Patel and Emily Wong are likely to make their payments late.

- Long overdue invoices help you track cash flow risks before they affect major business processes.

- Tracking each customer’s aging receivables allows you to personalize recovery communication.

Note: While all aging reports have the same core principle—categorizing overdue receivables by age, the format and complexity may vary depending on the business size, type, and industry. You may add or delete specific rows or columns to tailor an aging report to your business’s requirements.

What Two Aging Methods Are Available for Aging Reports?

Businesses typically choose between two aging methods when creating an aging report:

I. Aging by Invoice Date

Using this method, you can calculate the age of the invoice based on the original invoice date. It helps assess how long the invoice has been outstanding, regardless of its due date.

Best For: Businesses that want to track the overall lifecycle of their invoices and understand the total payment process.

II. Aging by Due Date

This method calculates the age of the invoice using the payment due date. Aging by due date allows you to understand the scenario of overdue accounts and organize the collection process. Most financial experts suggest using this method as it provides more actionable information.

Best For: Businesses that want to differentiate between chronic late payers and customers genuinely leveraging credit terms.

Both these methods offer valuable financial insights. Businesses use the most appropriate method depending on the context.

Learn How You Can Take Control of Debt Collection Through Automation

Read Our GuideAging in Accounts Receivable: Best Practices and Techniques

PYMNTS reported that about 91% of mid-sized businesses experienced an improved cash flow after implementing automation in their AR systems. Aging receivables management requires a systematic approach to protect cash flow and customer relationships. Effective strategies involve regular monitoring, active communication, and constructive collection efforts based on the value and age of the outstanding invoices.

You should establish clear processes for each aging segment. While the current receivables may require gentle payment reminders, those overdue by more than 90 days may require smarter collection tactics. Here are some best practices for preventing bed debt from piling up:

✦ Regular Report Generation

Most successful businesses generate aging reports regularly, mostly once a month, to ensure that collection issues are identified quickly and addressed before they turn into major financial barriers.

✦ Automated Reminders

Modern businesses leverage technology to automate payment reminders by sending gentle reminders to customers. A branded, customer-first approach—like the one used by Recuvery—is an effective way to enhance debt recovery while maintaining customer satisfaction.

✦ Comprehensive Analytics and Reporting

Beyond the basic aging reports, successful AR management includes comprehensive analytics to track the overall performance and identify trends. Advanced reporting systems can identify payment patterns, customer behaviour, and the effectiveness of collection approaches.

Customer-First Collection and Recovery Strategies for Aging Receivables

Rather than following conventional recovery strategies, balance securing overdue payments and maintaining positive customer relationships. The most successful strategies have empathy as their foundation, recognizing that customers facing payment challenges often need support and understanding. Recuvery exemplifies this customer-first approach.

| Aging Stage | Days Overdue | Recommended Approach |

| Early Stage Collections | 31–60 Days | Gentle but persistent communication is the most effective for receivables in the early stages of aging. This includes friendly multi-channel reminders to resolve payment issues while nurturing positive customer relationships. |

| Intermediate Collections | 61–90 Days | As receivables move into the 61–90 days segment, collection efforts need more structure while maintaining compliant and supportive tones. This stage may involve slightly more frequent yet respectful communication. Customers facing financial hurdles respond better to collaborative approaches rather than punitive measures. |

| Advanced Collections | Over 90 Days | At this stage, most businesses resort to aggressive and harassing measures, typically losing customers forever. However, receivables overdue by 90+ days require specialized expertise and compassionate understanding. |

No matter which aging segment your customers belong to, a supportive and mutual resolve goes a long way. This is where Recuvery becomes your partner in efficient debt collection.

Recuvery solves these collection hassles by offering your customers the provision to pay their debts through flexible payment plans. Using cutting-edge technology, Recuvery automates your entire debt collection process, from the first reminder to the final follow-through.

How Recuvery Makes Debt Collections Effortless

Aging reports help businesses identify customer accounts that would benefit from professional collection expertise, whether newly overdue (31-60 days) or critically aged (90+ days). Recuvery provides faster resolutions and better recovery rates for all segments, giving your aging reports a much better shape with time.

Recuvery allows your customers to take control of their payments, eliminating the need for your team to chase them constantly. Recovery’s unique approach offers them the options to pay in full, partially, or even set up a flexible payment plan that fits their budget.

When compared to the traditional collections approach, Recovery is better in many ways:

| Traditional Debt Collection | Modern Recovery with Recuvery |

| Aggressive calls and intimidating notices | Friendly, brand-aligned automated communication |

| Generic reminders are sent to every customer | Personalized, behavior-based outreach |

| High agency commissions (25–30%) | Minimal recovery costs with higher efficiency |

| No visibility into progress or status | Real-time tracking via dashboards and mobile access |

| Damages long-term customer relationships | Preserves customer loyalty with empathy and clarity |

| Risk of non-compliance and legal trouble | Built-in credit bureau reporting |

Conclusion: How To Prevent the Aging of Receivables

An aging report is one of the most powerful financial tools for managing accounts receivable and maintaining a healthy cash flow. An effective aging report management strategy involves regular analysis and prompt action on the insights. Remember that aging reports are not simply retrospective documents, but forward-looking tools that can help your business build stronger financial foundations.

Whether dealing with current receivables or overdue accounts, having accurate data and streamlined processes enables better decision-making and collection outcomes. While most businesses may consider partnering with a traditional debt collection agency to handle overdue payments, switching to a smart automated debt collection software like Recuvery has remarkable benefits.

Consider Recuvery’s automated reminders and flexible payment options to help customers pay off their debts without worrying about their budgets, while cultivating positive relationships and mutual benefits.

Frequently Asked Questions About Aging Reports

1. What Do Aging Reports Mean for Cash Flow Management?

Aging reports indicate how long your customers are taking to pay their bills. Older receivables represent potential or existing cash flow problems and need more focused collection efforts to recover.

2. How Can Businesses Improve Their Accounts Receivable Aging?

Businesses can improve accounts receivable aging by adopting automated collection tools that offer unique solutions for customers to pay off their debts. One example is Recuvery, an automated debt collection software that allows customers to choose flexible payment options as per their budgets and clear their debts.

3. What Is “Aged Receivables”?

Aged receivables are the outstanding invoices that have exceeded their due dates. They affect business operations by reducing cash availability and increasing administrative costs.

4. I Have Overdue Invoices but Don’t Know Where To Start—How Can Aging Accounts Receivable Help Me Prioritize?

Aging accounts receivable helps you identify which customers owe you the most and have been late the longest. It becomes your roadmap when multiple customers owe you a debt. For example, you would prioritize reaching out to Customer X, who owes you $5000 for 90 days, over Customer Y, who owes $500 for 35 days.